2025 Beneficial Ownership Information Reporting Form – Where can i find the form to report? Beneficial ownership information reporting requirements are now back in effect, with a new deadline of march 21, 2025, for most companies. If a reporting company is created or registered to do business in the united states on or after january 1, 2024 and before january 1, 2025, it must file its initial. Department of the treasury's financial crimes enforcement network (fincen) began accepting beneficial ownership information reports.

Beneficial ownership information reporting requirements are now back in effect, with a new deadline of march 21, 2025,. With the february 18, 2025, decision by the u.s. The financial crimes enforcement network (fincen) will extend the current march 21 beneficial ownership information (boi) reporting deadline, has suspended boi enforcement, and will develop new regulations it says will reduce regulatory burden, the agency said thursday. Indicating that companies must report beneficial ownership information before march 21, 2025, should be disregarded.

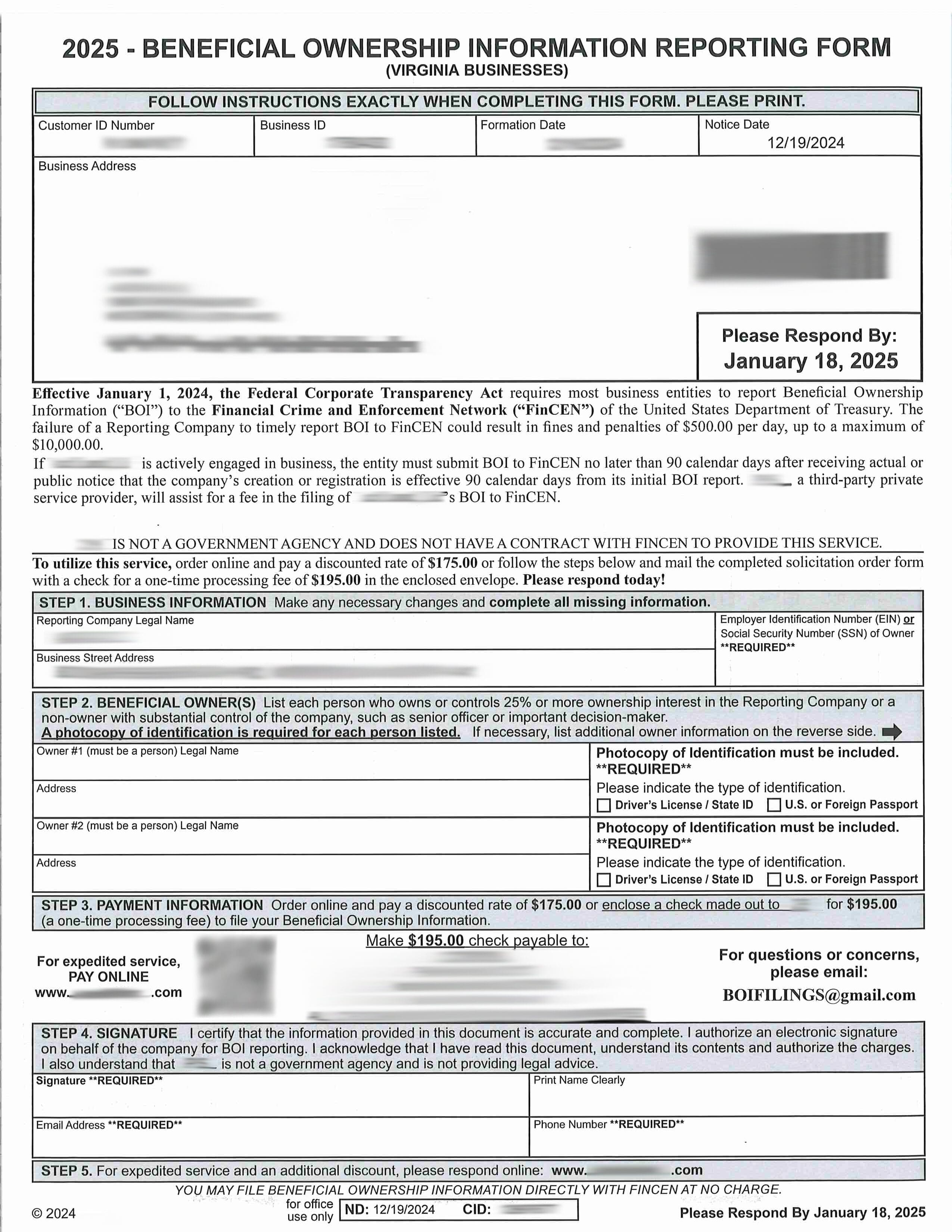

2025 Beneficial Ownership Information Reporting Form

2025 Beneficial Ownership Information Reporting Form

The treasury department is announcing today that, with respect to the corporate transparency act, not only will it not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing regulatory deadlines, but it will further not enforce any penalties or fines against u.s. We last visited fincen's beneficial ownership information (boi) reporting requirements in my article, the fincen beneficial ownership information reporting deadline might be extended, but prepare. The initial beneficial ownership information reporting is based on the date your company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice.

Citizens or domestic reporting companies or their beneficial owners. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business. District court for the eastern district of texas in smith, et al.

Request for taxpayer identification number (tin) and certification. Existing companies have one year to file; Tex.), beneficial ownership information (boi) reporting requirements under the corporate transparency act (cta) are once again back in effect.however, because the department of the treasury recognizes that reporting.

Complete Guide to Beneficial Ownership Information BOIFinCEN Reporting

CTA FinCEN Beneficial Ownership Information Reporting Begins 1/24 Austin CPA Firm Millan + Co. PC (512) 4796819

Federal Register Beneficial Ownership Information Reporting Requirements

Beneficial Ownership Reporting Schemes Deceptive Letters

How to File BOI Report in California Ultimate Guide (2025)

January 1 deadline approaching for reporting Beneficial Ownership Information

Beneficial Ownership Information FinCEN.gov

Understanding FinCEN Beneficial Ownership Reporting Explained Capital Investment Advisors

Beneficial Ownership Information FinCEN.gov

FinCEN Beneficial Ownership Information Reporting YHB CPAs & Consultants

Beneficial Ownership Information FinCEN.gov

Beneficial Ownership Information FinCEN.gov

BOI Reporting Scam Ketel Thorstenson CPA Advisors

Free Beneficial Ownership Information (BOI) Report PDF eForms

Beneficial Ownership Information New Reporting Requirement for Small Businesses Alloy Silverstein