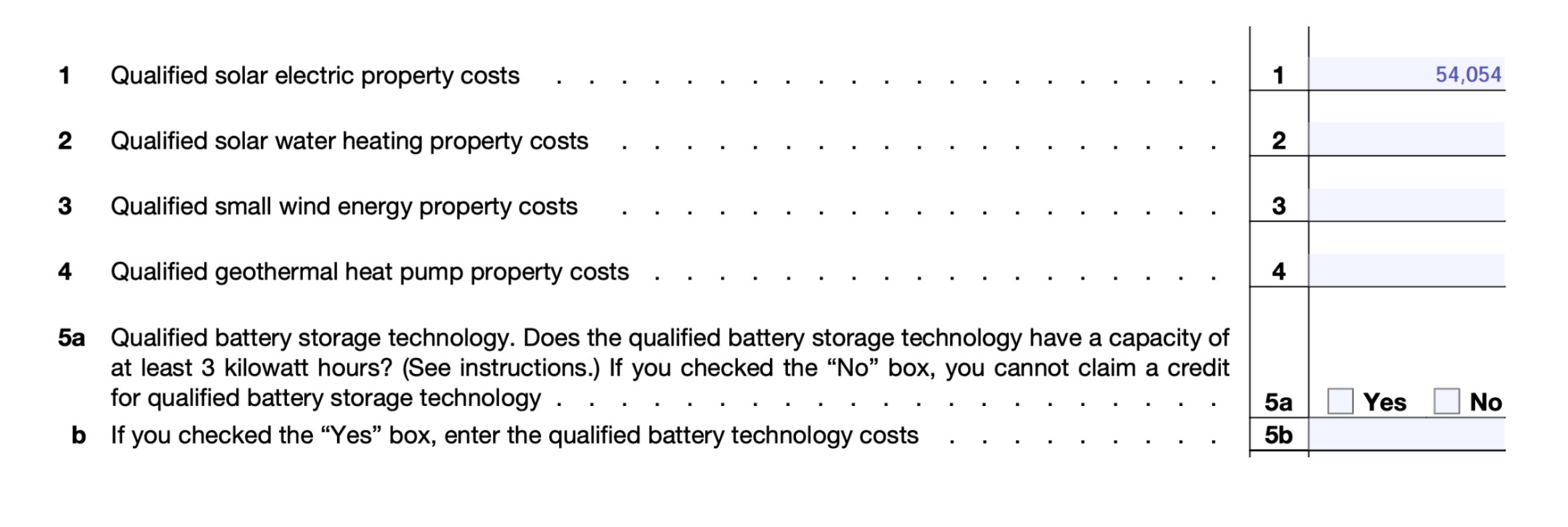

Form 5695 2025 – Energy tax credits can significantly reduce your tax liability. If zero or less, enter ‐0‐ on form 5695, lines 14 and 15: These documents include receipts, certifications, and any applicable utility rebate information. 2 part ii energy efficient home improvement credit section a—qualified energy efficiency improvements 17 a.

This form helps taxpayers who have made eligible energy improvements to their homes. Filling out irs form 5695 involves understanding two distinct sections. Proper completion protects your investment and claims energy credits efficiently. Attach all required documentation with your tax return.

Form 5695 2025

Form 5695 2025

Irs form 5695 is used to claim residential energy tax credits on your federal tax return. As of now, the 2024 irs form 5695 is currently available in turbotax.

Discover when form 5695 is typically released, factors influencing its availability, and how to confirm its release for your tax filing needs. If line 15 is less than line 13, subtract line 15. You can also check when tax forms, like form 5695, are available in turbotax tool.

Are the qualified energy efficiency improvements installed in or on your main home located in the Home/credits and other specific purpose forms/ form 5695. With the increasing focus on sustainable living and renewable energy, this.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Completing form 5695 correctly maximizes your solar energy tax credits. Last updated january 19, 2025 10:50 am.

IRS Releases Form 5695 Instructions and Printable Forms for 2023 and 2024

How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

Form 5695 Instructions & Information Community Tax

Dl 5695 Fill out & sign online DocHub

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Form 5695 Which renewable energy credits apply for the 2023 tax deduction? Marca

How Residential Solar Tax Credit Work In 2025

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Residential Energy Credits

How to Claim the Solar Panel Tax Credit (ITC)

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

IRS Form 5695 Instructions How to Claim the Solar Tax Credit (2024 Tax Year)

Form 5695 YouTube

Completed Form 5695 Residential Energy Credit Capital City Solar

Federal 25C Tax Credit How to Claim (2024) UniColorado